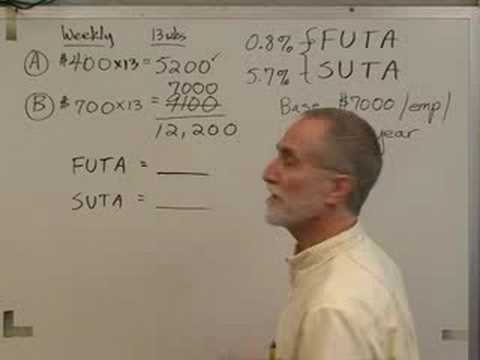

Let's talk about the unemployment tax, specifically the federal unemployment tax act (FUTA) and the state unemployment tax act (SUTA). FUTA and SUTA are taxes that employers pay on behalf of their employees. These taxes are considered insurance policies mandated by the government to cover unemployment or disability benefits. The federal unemployment tax is always .8%, as long as someone participates in a state program. The state program's tax rate will vary depending on the employer. It's similar to auto insurance where premiums increase when accidents occur. If an employer frequently lays off employees, they will incur higher costs for the program. On the other hand, employers with a good employment record may receive a lower rate. Both rates will be stated in the problem. Let's use an example to understand better. Suppose the state rate in this case is 5.7%. The employer only has to pay this tax on the first $7,000 of earnings per employee per year. Regarding social security, employers have to pay 6.2% on the first $87,900 per employee per year. The FUTA and SUTA have the same upper limit of $7,000 per employee per year. In this example, we have two employees, Employee A and Employee B. Employee A earns $400 per week, and Employee B earns $700 per week. Now, for the first quarter, which is thirteen weeks, we need to calculate how much the employer has to send to the federal and state government for the federal unemployment tax and state unemployment tax of these two employees. To do this, let's calculate the earnings for thirteen weeks. Employee A's earnings would be $400 multiplied by thirteen, which is $5,200. Employee B's earnings would be $700 multiplied by thirteen, which is $9,100. Now, we need to determine the tax amount for each employee based on their earnings. Since...

Award-winning PDF software

940 (PR) Form: What You Should Know

Form 940-PR As of 2017, forms 940 and 940-PR are electronic returns only. You may have other formats (paper returns) but you can't upload and e-file them through the Tax Form Fillable. Tax filing is simple if you have done the basics. In fact, it is easier than filing one on paper. For more details, be sure to read Chapter 18 of IRS Publication 519, U.S. Individual Income Tax. Form 940 The form you used to report your federal unemployment tax. It is a tax record that allows you to get a refund of any tax that you owe, but not for any other reason. Form 940 is the most reliable form to use for your federal Unemployment tax payments if you are filing with the IRS. Form 939 is for regular tax years after 2005, or certain other forms that need to be filed by the Internal Revenue Service. Form 940 is a statement that reports your federal jobless benefits and the amount of your total federal unemployment tax. Most employers file their Form 940 by July 31. To find out how much unemployment benefits you'll get, you'll need to do your business returns first. Form 940 is a self-employment tax return that reports the income tax withheld from your pay. Form 940 may include Form 1040, U.S. Individual Income Tax Return, but also may report Form 940-ES, Supplemental Security Income Return, which provides a lower tax credit to certain disabled and elderly people who receive SSI payments. If so, you will include this report on Form 940. Form 940 is a self-employment tax return that shows your quarterly federal employment tax statements showing you are working for yourself. The statement must be completed and signed on a paper, not by fax or online. The form must be filed by April 30, but most people file it by this date. There are three ways to prepare your form 940. Each has advantages and disadvantages. Online — For more detailed instructions and details about the forms that can be filed online, go to IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 940 (PR), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 940 (PR) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 940 (PR) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 940 (PR) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 940 (PR)